Company Registration Made Easy

Start your business journey with our streamlined company registration process. We offer comprehensive packages to suit your needs and budget.

Our expert team ensures a smooth and hassle-free registration experience.

Start your business journey with our streamlined company registration process. We offer comprehensive packages to suit your needs and budget.

Our expert team ensures a smooth and hassle-free registration experience.

A Public Limited Company is a joint-stock association of members and is managed by the rules and regulations laid by the government under the Companies Act, 2013. The company has the right to list the stocks for the general public to generate capital and its stocks can be easily purchased by people through IPOs(Initial Public Offerings) or by trading on the stock exchange.

With Filinglounge, the process of registering a Public Limited company is way too simplified and hassle-free. Kindly visit our website https://startupindiaonline.in/public-limited-company.php for registering your company and getting the fee-related details.

Public Limited Companies are separate legal companies and function independently. Also, they are entitled to have their distinctive identity by having a PAN, bank account, assets, etc.

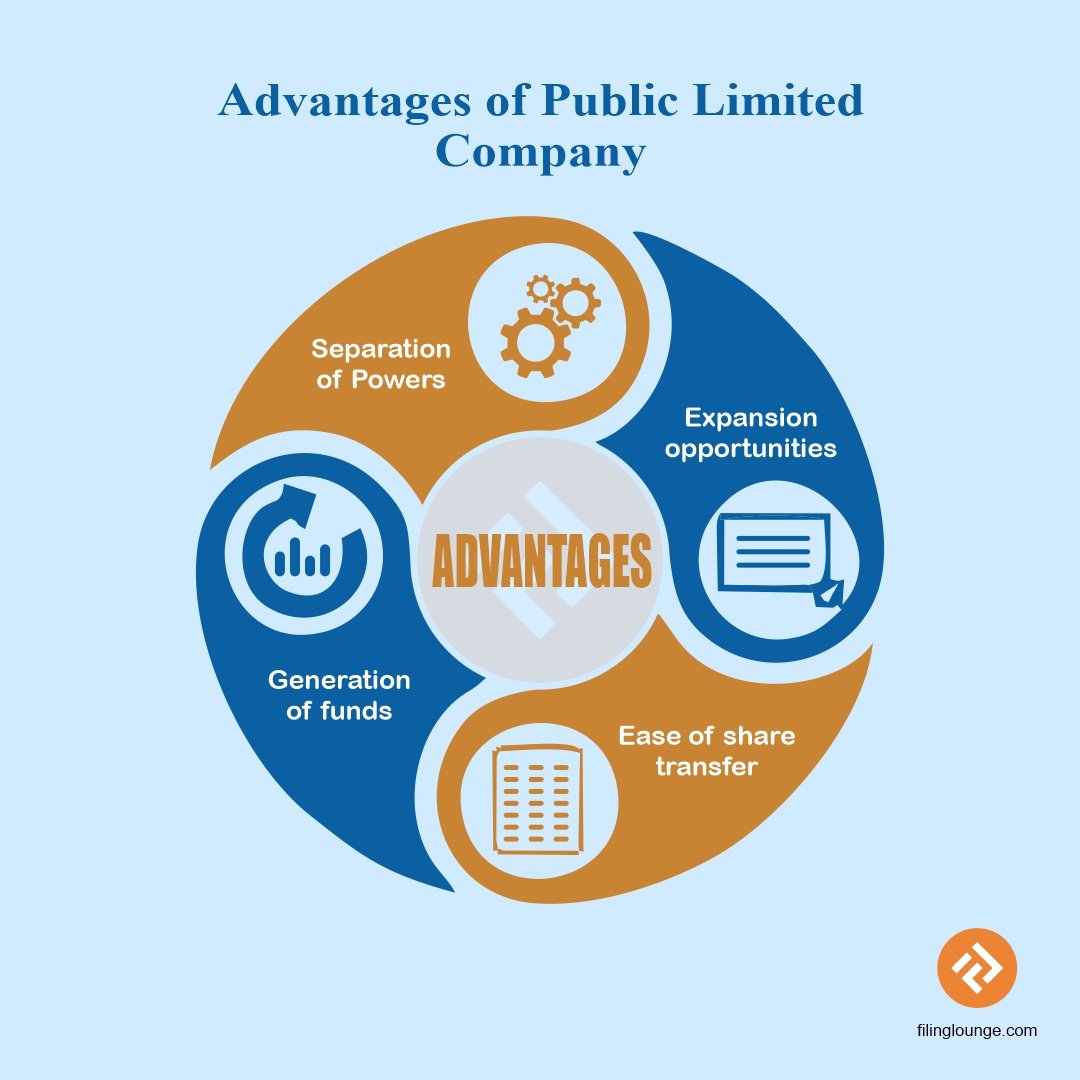

Public limited companies seem quite attractive to investors such as banks and other financial institutions. Also, these companies can raise capital by issuing equity or preference shareholding or by issuing security/insecurity debentures.

This is a major benefit of Public Limited Companies that the shares can be easily transferred to other companies or individuals. Also, if the director needs to be changed for perpetual succession, it can be easily done by completing a few formalities.

Public limited companies are on the lower side of risk when it comes to business expansion. They are eligible to get financial aid easily and they can generate funds by listing their stocks on the exchange. Also, as the shares are available to a wide range of people, therefore, the uncertainty of the market fluctuations doesn't have much impact on the overall. Thus, Public companies have dignified growth potential.

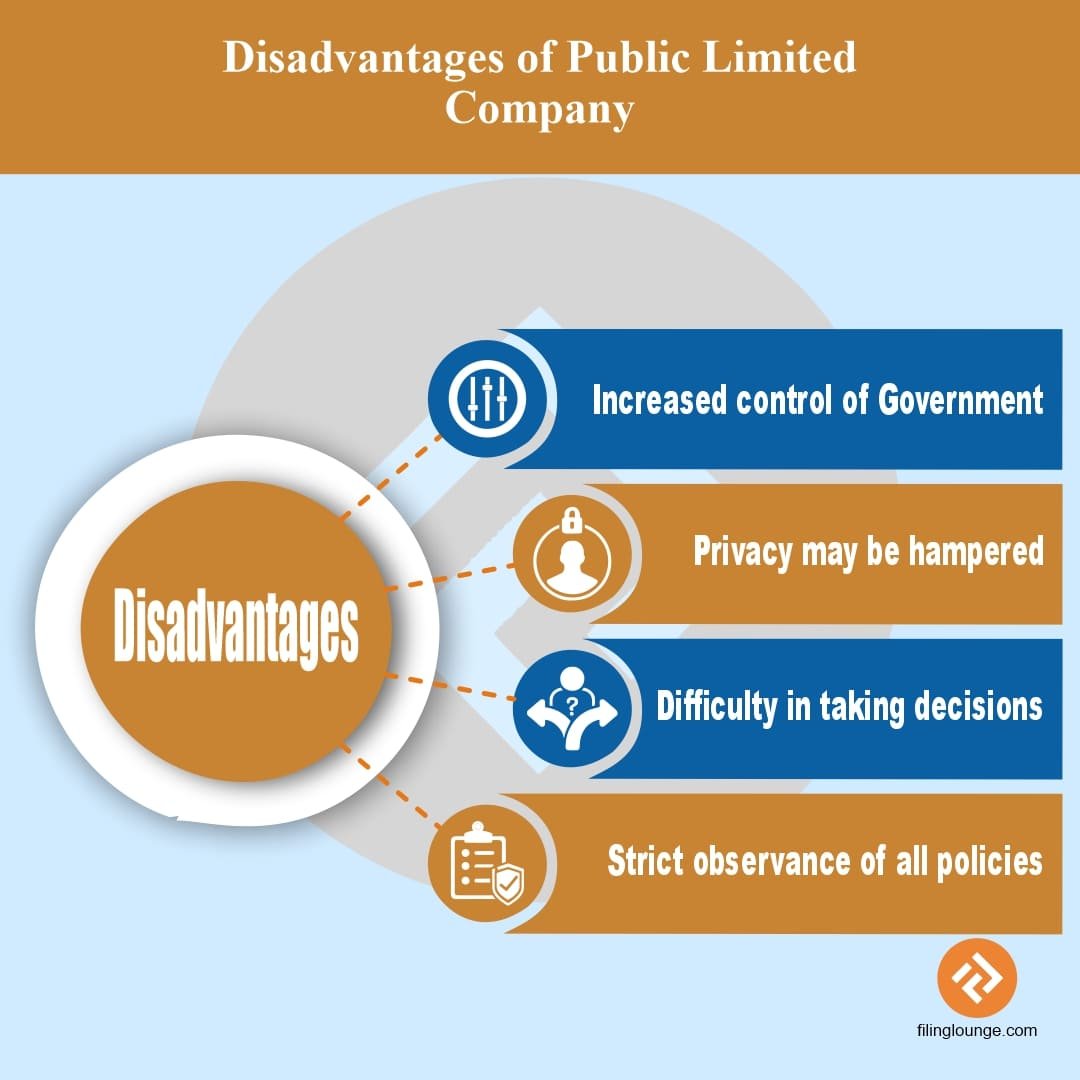

As Public Limited Companies are larger organizations, they must meet the regulatory standards set by the government. Hence, there's increased surveillance on them by the government agencies like the IRS and all the policies and procedures are required to be fulfilled in all terms.

Public Limited Companies must furnish all the reports to the overall public as well as to the regulating bodies. There should be clear-cut transparency and it must be noted that the rules and regulations are strictly followed.

The decisions of the Public Limited Companies are in the hands of many people. Thus, decisions regarding many trivial matters might get delayed due to differences in opinions among the members.

Public Companies have to let their company details open to the public and therefore there is lesser privacy regarding the company matters.

Filing Lounge has an experienced team of professionals who can serve as the best financial consultants for all your queries. Our charges are inexpensive and once you attach with us, it becomes our responsibility to handle your queries and all obligations with utmost precision.