Company Registration Made Easy

Start your business journey with our streamlined company registration process. We offer comprehensive packages to suit your needs and budget.

Our expert team ensures a smooth and hassle-free registration experience.

Start your business journey with our streamlined company registration process. We offer comprehensive packages to suit your needs and budget.

Our expert team ensures a smooth and hassle-free registration experience.

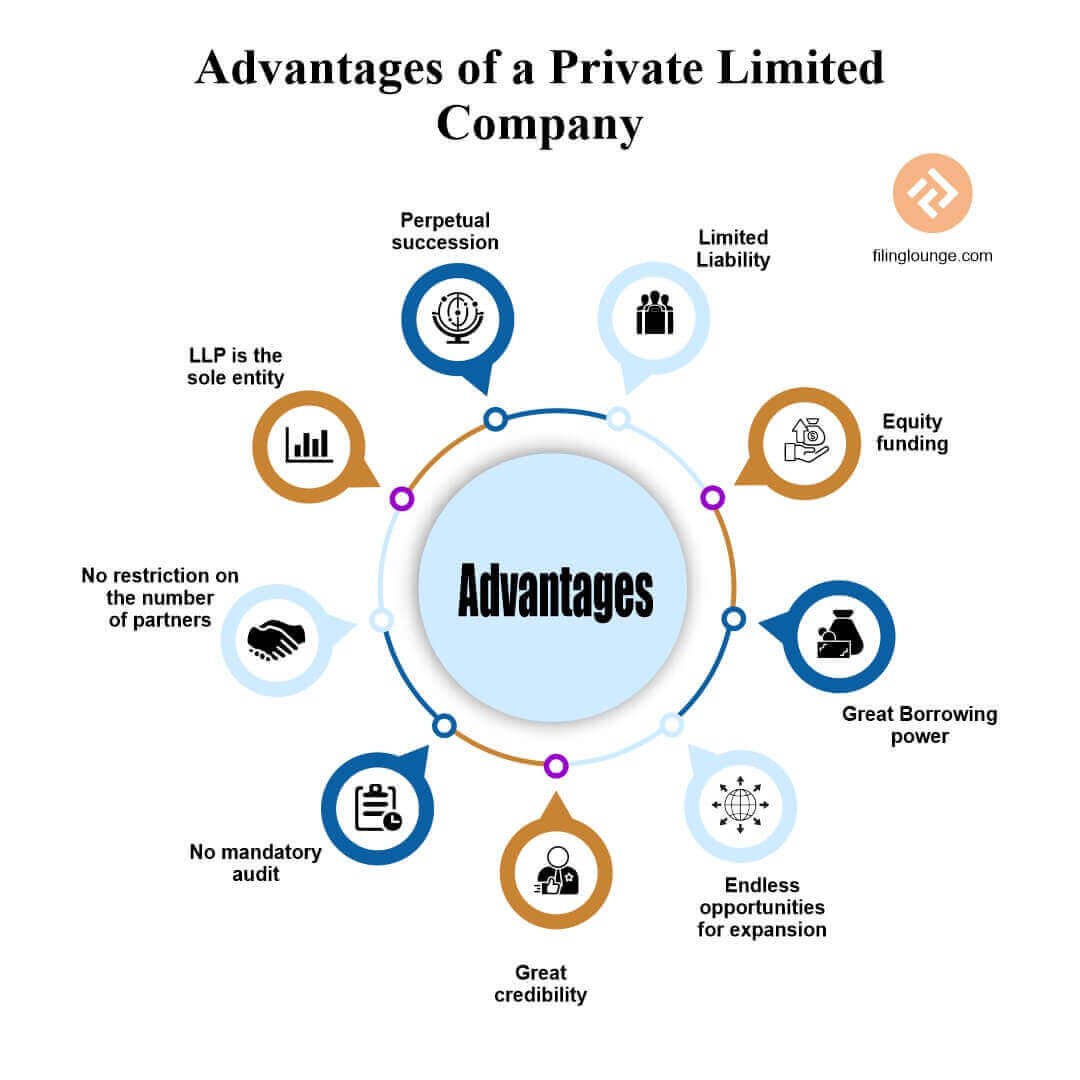

Under section 2 (68) of the companies Act, 2013, a Private Limited Company is a company having a minimum paid-up share capital and which by its articles -

A company must fulfill the following conditions to be registered as a Private Limited Company:

The process of registering a Private Limited Company is quite simple and hassle-free. Here is a step-by-step guide on how to register a Private Limited Company:

Note: The documents have to be self-attested copies and should be properly scanned. Also, all the bills should not be older than two months.

We at Filinglounge assist you in registering your Private Limited Company with utmost ease. We have a team of experienced professionals to take care of all the requirements including the documentation and ensure timely support and proper management. Please Follow our Facebook page for regular updates.